BlackBuck Secures SEBI Approval for INR 550 Cr IPO

Logistics unicorn BlackBuck, operated by Zinka Logistics Solutions, has received the green light from the Securities and Exchange Board of India (SEBI) for its upcoming Initial Public Offering (IPO) worth over INR 550 Cr. SEBI issued its final observation letter to BlackBuck on October 3rd, marking a significant milestone for the B2B logistics marketplace.

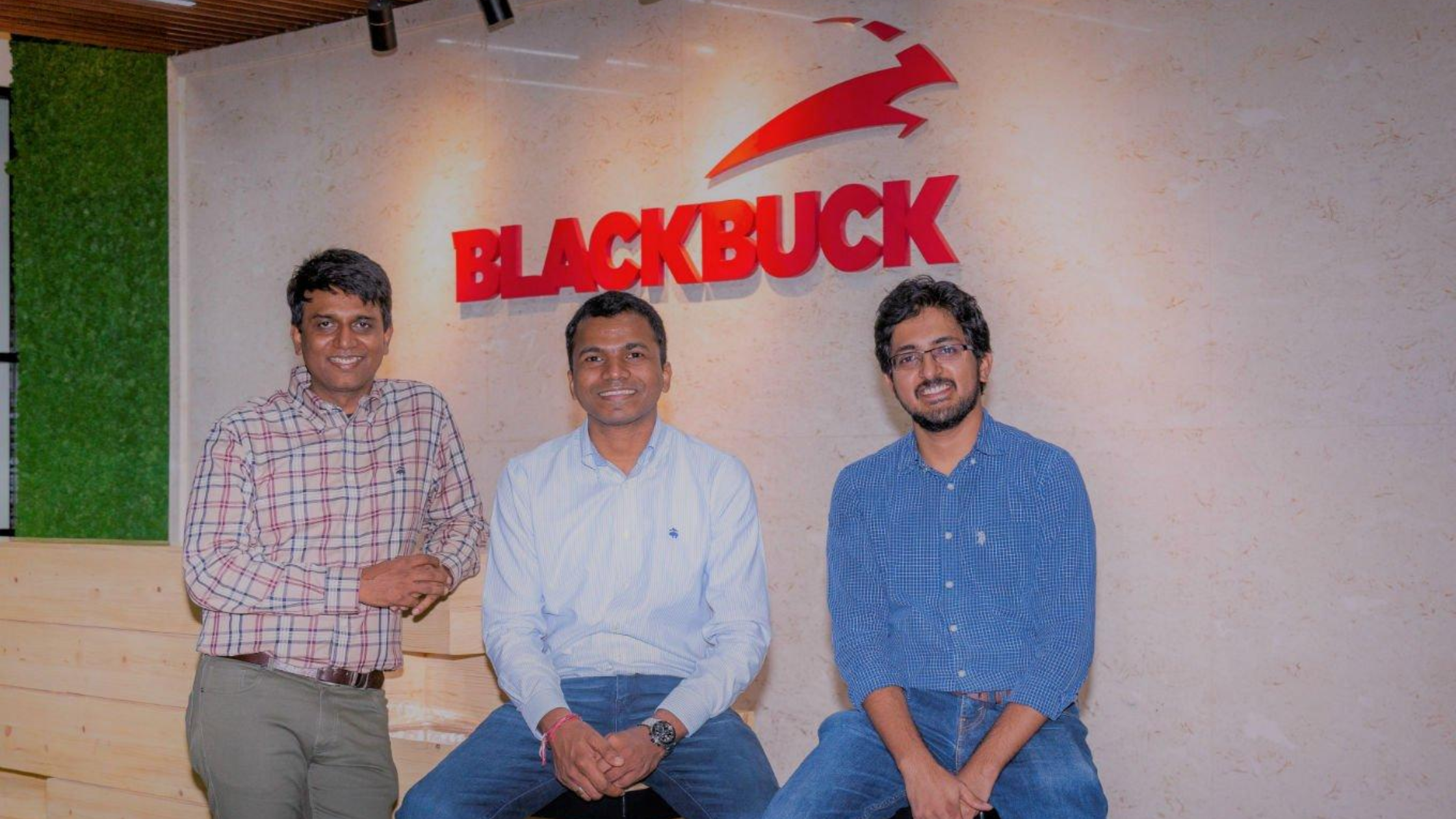

Founded in 2015 by Rajesh Yabaji, Chanakya Hridaya, and Rama Subramaniam, BlackBuck connects truck operators with businesses that require shipping solutions across India. The platform offers real-time freight matching, payment solutions, load management, telematics, and vehicle financing.

IPO Details:

The issue includes fresh equity worth INR 550 Cr and an offer for sale (OFS) of up to 2.16 Cr shares.

The three co-founders will offload 44.37 Lakh shares through the OFS, with Yabaji selling 22.18 Lakh shares and the others 11.09 Lakh shares each.

Fund Utilization:

INR 200 Cr will be allocated to sales and marketing.

INR 140 Cr will go towards BlackBuck’s NBFC subsidiary, Blackbuck Finserve Pvt Ltd.

Additional proceeds will fund product development and general corporate purposes.

Axis Capital, Morgan Stanley, JM Financial, and IIFL Securities are the lead book-running managers for the IPO.

Despite its net losses narrowing by over 30% to INR 194 Cr in FY24 from INR 290.4 Cr the previous year, BlackBuck saw a 69% increase in operating revenue, reaching INR 296.9 Cr. This strong growth trajectory places BlackBuck among several Indian startups riding the current IPO wave alongside names like Swiggy, Ola Electric, and Ather Energy.

As BlackBuck prepares to go public, its focus remains on strengthening its tech-enabled logistics platform and expanding its offerings across India’s booming logistics sector.

Leave a Comment